How NFT Game Loot Boxes Could Be Regulated Like Casino Mechanics

Picture this scenario. A player spends $50 worth of cryptocurrency to open a digital loot box in their favorite blockchain game. The smart contract runs its randomization function, displaying odds of 0.1% for the rarest item—a legendary sword NFT. They don’t win it this time, but someone else does. That sword immediately appears on OpenSea for $3,000.

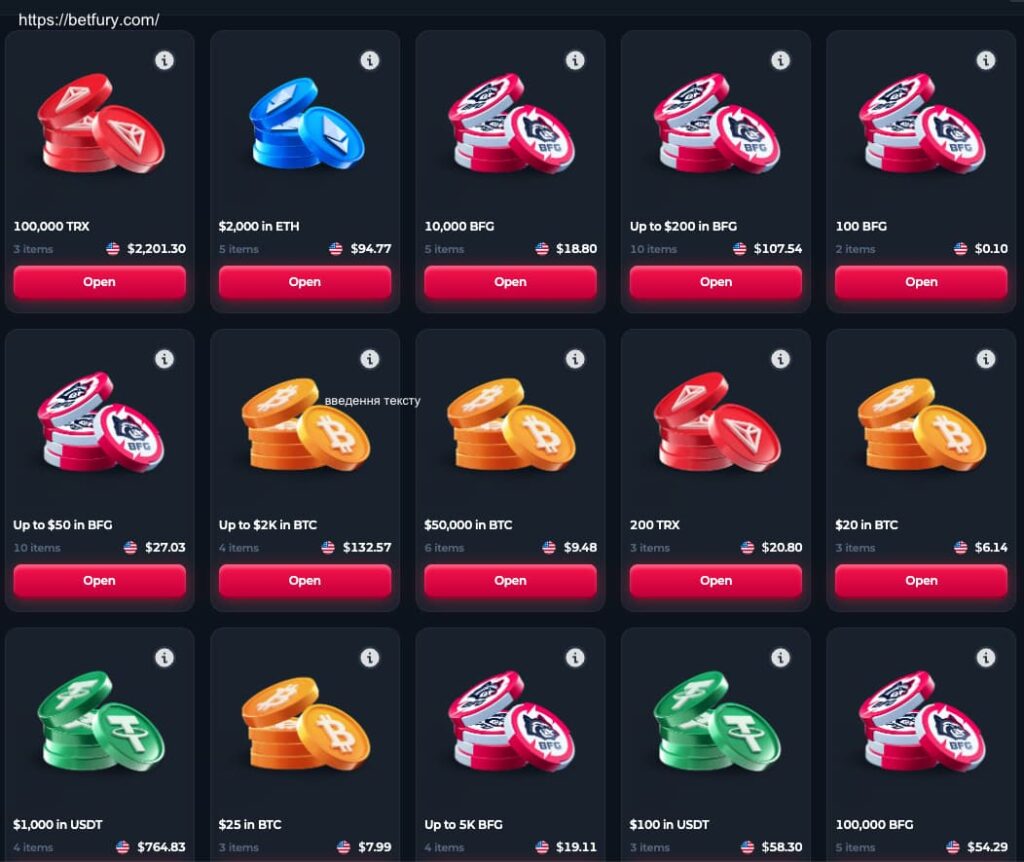

What makes this different from regular loot boxes? The sword exists as an NFT on the blockchain. The player who wins it can sell it for actual money. Platforms like BetFury’s NFT Lootboxes already demonstrate this model in action, with transparent odds written into smart contracts and immediate marketplace integration. Regulators are starting to notice these features look suspiciously like casino mechanics.

How NFT loot boxes work (in 60 seconds)

Players stake money—either fiat converted to crypto or cryptocurrency directly—to purchase a loot box. The game runs a randomized draw using either on-chain or off-chain random number generation. Winners receive prizes as NFTs, which means they own a blockchain token representing their item.

Here’s where things get interesting. Unlike traditional game items locked inside one platform, NFT prizes can be listed on secondary markets. Players cash out by selling to other players. The entire system runs on smart contracts that automate the purchase, randomization, and prize distribution. Some games even publish their odds directly on-chain, making them auditable by anyone.

Casino mechanics 101: where the similarities start

Walk into any casino and you’ll see familiar patterns. Players stake money. Random number generators determine outcomes. The house publishes odds and payout tables. Age verification happens at the door. Winners can cash out their chips for real money.

NFT loot boxes mirror these mechanics closely enough that regulators are taking notice.

Casino mechanic vs. NFT loot box feature

| Mechanic (casino) | Comparable NFT feature | Why regulators care | Typical control (casino) | Feasible control (NFT) |

| Money stake | Crypto/fiat box purchase | Real value at risk | Bet limits | Transaction caps |

| RNG outcome | Smart contract randomization | Fairness concerns | Third-party testing | On-chain verification |

| Chips/credits | NFT items | Intermediate value storage | Internal tracking | Blockchain records |

| Cash-out desk | NFT marketplace resale | Money extraction point | KYC requirements | Wallet verification |

| Posted odds | On-chain probabilities | Consumer protection | Mandatory disclosure | Smart contract transparency |

| Age check | Account creation | Minor protection | ID verification | Wallet-based gates |

The comparison isn’t perfect. Casino games typically resolve in seconds while NFT reveals might involve animations and delays. Casinos control their entire ecosystem while NFT games operate across multiple platforms and chains. But the core loop—stake, chance, prize with monetary value—remains strikingly similar.

When gambling laws might apply

Most jurisdictions use three tests to determine if something constitutes gambling: consideration (players risk something of value), chance (outcomes depend on randomness rather than skill), and prize (winners receive something of value).

Traditional loot boxes often skirt these rules because items can’t be officially cashed out. Game companies maintain that their virtual swords and skins have no real-world value since their terms of service prohibit selling accounts or items for money. Courts and regulators have sometimes accepted this argument, sometimes not.

NFTs demolish this defense. When your legendary sword is an NFT, its transferability and convertibility to money are features, not bugs. The UK Gambling Commission’s advisory group notes in their loot box guidance that “where in-game items obtained via loot boxes can be cashed out” the activity risks crossing into regulated gambling territory. NFTs are designed specifically to be cashed out.

Different countries draw these lines differently. What flies in one jurisdiction might trigger enforcement in another. Game studios can’t assume that blockchain technology somehow exempts them from existing rules.

Snapshot of current regulatory approaches

Belgium moved first, declaring certain paid loot boxes illegal gambling in 2018. The Belgian Gaming Commission specifically targeted games where players could pay real money for randomized rewards, regardless of cash-out potential. Publishers pulled their loot boxes from the Belgian market or redesigned them.

The UK takes a different approach. The Gambling Commission generally doesn’t classify loot boxes as gambling unless prizes can be monetized. But they’re watching closely. Their November 2024 guidance emphasizes using consumer protection laws and industry self-regulation rather than gambling legislation—for now.

The European Parliament wants harmonization. Their January 2023 report on consumer protection in online video games urged member states to adopt consistent approaches to loot boxes, particularly regarding minors. They stopped short of demanding universal gambling classification but highlighted the need for better odds disclosure and spending controls.

Jurisdiction stance at a glance

| Jurisdiction | Current position | Key trigger | Notable guidance |

| Belgium | Paid loot boxes = gambling | Real money payment | Gaming Commission ruling (2018) |

| UK | Consumer law approach | Cash-out capability | UKGC advisory (Nov 2024) |

| EU Parliament | Harmonization push | Minor protection | Consumer report (Jan 2023) |

| Netherlands | Case-by-case review | Transferable value | Kansspelautoriteit decisions |

| China | Mandatory odds disclosure | All paid boxes | SAPPRFT regulations (2017) |

If casino-style rules were applied to NFT loot boxes, what would change?

Studios would need to implement comprehensive compliance systems. Start with mandatory odds disclosure—not buried in smart contracts but displayed prominently before purchase. China already requires this for all loot boxes, showing exact percentages for every possible outcome.

Age verification would become mandatory, not optional. Real identity checks, not just clicking “I’m over 18.” KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures would apply to both purchases and cash-outs. Regulators would demand documentation of who’s playing and where their money goes.

Game fairness audits by licensed third parties would replace trust in developers’ good intentions. Just as slot machines undergo testing, NFT loot box algorithms would need certification. Random number generation, payout rates, and odds calculations would face scrutiny.

Marketing would face heavy restrictions. No targeting minors. No misleading claims about odds or potential winnings. Mandatory warnings about gambling risks. Some jurisdictions might ban advertising entirely.

Studios would need to implement player protection tools: deposit limits, loss limits, time-outs, and self-exclusion systems. Transaction records would need to be maintained for years, available for regulatory inspection.

Marketplaces and blockchain platforms wouldn’t escape scrutiny. They’d likely face pressure to implement their own KYC systems and potentially block transactions from flagged addresses or jurisdictions.

Risk checklist for studios & publishers

Smart studios are already adapting. Here’s what forward-thinking developers are doing:

- Disable or restrict resale – Lock NFTs for a period after minting or permanently bind them to accounts

- Implement transparent odds – Display exact probabilities before purchase, update them in real-time

- Add spending safeguards – Daily, weekly, and monthly purchase limits with cool-down periods

- Use verified RNG – Chainlink VRF or similar auditable randomness sources

- Deploy geo-blocking – Detect and restrict access from high-risk jurisdictions

- Age-gate properly – Real verification, not honor system checkboxes

- Test with third parties – Get algorithmic audits before launch, not after regulatory action

- Maintain detailed records – Every transaction, every player, every outcome, timestamped and immutable

Resources & further reading

The implementation of NFT loot boxes continues to evolve as platforms balance innovation with regulatory compliance. Current systems demonstrate both on-chain odds disclosure and marketplace integration features that regulators are examining closely.

FAQ

Are NFT loot boxes legal in the UK? The UK Gambling Commission doesn’t currently classify most loot boxes as gambling, but NFT loot boxes with cash-out features enter gray territory. The Commission warns that items convertible to money may trigger gambling laws. Studios should seek legal counsel for specific implementations.

Do NFT loot boxes need odds disclosure? China mandates odds disclosure for all paid loot boxes. The EU Parliament recommends it. Even where not legally required, transparent odds build player trust and may help avoid future regulatory action.

How do KYC and age checks apply to NFT games? If classified as gambling, full KYC becomes mandatory—government ID, proof of address, age verification. Some studios implement lighter “KYC-lite” voluntarily, checking ages without collecting extensive personal data.

Can disabling resale avoid gambling rules? Possibly, but it defeats the purpose of using NFTs. Belgium’s position shows that even without cash-out, paid random rewards can constitute gambling. Disabling resale might help in some jurisdictions but isn’t a universal solution.